WorldPay/CardSave

A core element of Cardsave strategy is to ensure that Cardsave’s vision of “To become a leading payment solution provider” is enabled through transformational change. To support this strategy Cardsave has initiated a number of activity streams to simplify the business, raise professional standards, increase personal accountability and reduce costs. In order to achieve this, CardSave is investing in people, processes, and technology changes across the organization and a major program for Cardsave is being managed within a business process change project known as “Cardsave Re-Engineering” which is contributing to this strategy. This drive for continuous improvement is enabling Cardsave Executives to have a better view of data, cost, and future forecasts.

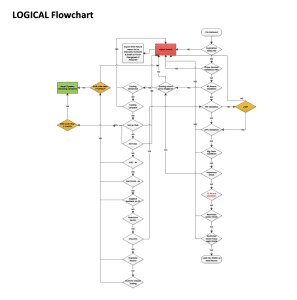

The TPS/CTPS Controls (CTC) Project has been initiated to address Ofcom requirements by suppressing customer details where the customer’s mobile/telephone matches against the latest TPS/CTPS extract.

2nd phase of this project ensures TPS/CTPS data is screened out before loading into the dialler; a separate document would be produced to explain the process and limitations.

SSRS, SSIS, SSAS Consulting Company in Dallas | Lahore | Nottingham

Miaz-Tech’s full-stack SSRS specialists bring together the experience and soft skills you need in a single turn-key package to complete your project on schedule and on budget. Our experts help you select the right technologies, languages, libraries, and toolsets for your company and ensure your project is done right from the start, whether working with us independently or in a co-development setting.

Reporting Process

There are currently close to 200,000 records marked as pipelines in the CardSave dialler. Each agent holds approximately 800 Same Agent Call backs. The priorities set in the dialler around pipeline means that some of the pipelines effectively become unloved rather than nurtured, particularly when the prospect has been held in it for a considerable length of time.

There are only 76,642 SACB in the E2 pipeline and if I am not wrong we migrated all pipelines from E1- so n. Can you confirm who provided 200k figures?

Whereas System callbacks are 261,440

The pipeline is critical to the business and an in-depth understanding needs to be gathered to enable some decisions around an overall pipeline communication strategy.

- The analysis brief criteria.

High-level analysis of the numbers in the pipeline, the status, the time in the pipeline, the region, and the lead source. This data then needs to be cross-tabulated into a number of helpful views:

- We need to gain an understanding of the pipeline status. v. the length in that pipeline (irrespective of whether the status has moved within the pipeline).v. lead source.

- A regional view of this information should be gained and it should be available for the same agent call back section an agent.

- A lead source view should be available and should be available across the criteria.

- Has there been any change in trend over time in the way the pipeline behaves?

- Can call comments to be used to add to the picture?

- In addition to this, some analysis should be carried out to look at negative dispositions to see if there is potential in this area – the reasons are key for this.

This data needs to be analyzed over an 18-month period to get a view of the entire picture. Whatever method is used, it is essential that the data can be cut and cross-tabulated in any way with any number of the core criteria. It is also essential that there is a drill on the data so e.g. we could drill into an individual agent or lead source if required.

Report Development Strategy:

We would take a full extract from E1 with the following details:

-Address code

-Prospect ID

-Import Date

-Leadsource

-Sector

-SIC Code

-Agent/SSP Name

-Company Details

-First Call disposition AS SACB

-Last Call disposition AS SACB and/or another status

I would merge the E1 extract with E2 where possible via Address code. The final stage of the script would perform two actions here.

If the address code matches then update the last call status on the existing record

If the address code doesn’t match then insert a new record into the staging table.

With all required data into the staging table; SSRS Report would be built around the staging table which would have the following parameters/selection options

- Lead Source

- Start Date

- End Date

- Campaigns/Regions

The report would be developed in three stages to make sure all the key stakeholders are on board with the layout/UI and extracts.